Unlocking Financial Growth: Why "El Que No Invierte No Gana" Is More Than Just A Saying

Have you ever wondered why so many people struggle to achieve financial freedom despite working tirelessly? The answer lies in a simple yet powerful phrase: "El que no invierte no gana." This Spanish proverb translates to "He who does not invest does not win," and it encapsulates a universal truth about wealth-building. In today's fast-paced world, where opportunities abound but risks loom large, understanding the importance of investing is crucial. Whether you're saving for retirement, planning to buy a home, or simply aiming to grow your wealth, the principle of investing wisely can make all the difference.

Investing isn't just about putting money into stocks or real estate; it's about making strategic decisions that align with your financial goals. Many individuals hesitate to invest due to fear of loss or lack of knowledge, but the reality is that the biggest risk lies in doing nothing at all. The phrase "el que no invierte no gana" serves as a reminder that growth requires action, and action requires stepping out of your comfort zone. By embracing this mindset, you can unlock opportunities that lead to long-term financial success.

For those who are new to the concept of investing, the journey may seem overwhelming. However, with the right guidance and resources, anyone can learn to make informed decisions that yield positive results. From understanding the basics of compound interest to exploring diverse investment options, the path to financial growth is within reach. In this article, we'll delve deeper into the meaning and implications of "el que no invierte no gana," explore common questions about investing, and provide actionable insights to help you take the first step toward financial prosperity.

Read also:The Happiest Season A Celebration Of Joy Love And Togetherness

Table of Contents

- What Does "El Que No Invierte No Gana" Mean?

- Why Is Investing Important for Financial Growth?

- Who Can Benefit from Investing?

- What Are the Common Barriers to Investing?

- How Can You Start Investing Today?

- What Are the Best Investment Options for Beginners?

- Why Do Some People Think "El Que No Invierte No Gana" Is Risky?

- How Can You Overcome the Fear of Investing?

- What Role Does Compound Interest Play in Investing?

- How Can You Stay Consistent with Your Investment Strategy?

What Does "El Que No Invierte No Gana" Mean?

The phrase "el que no invierte no gana" is a timeless piece of wisdom that emphasizes the importance of taking action to achieve financial success. At its core, it suggests that inaction leads to stagnation, while calculated risks and investments pave the way for growth. This saying resonates with people from all walks of life, as it applies not only to financial investments but also to personal and professional development. Whether you're investing in stocks, real estate, education, or even relationships, the principle remains the same: progress requires effort and commitment.

Why Is Investing Important for Financial Growth?

Investing is a cornerstone of financial growth because it allows your money to work for you. Unlike saving, which simply preserves your capital, investing has the potential to generate returns that outpace inflation. This means that over time, your wealth can grow exponentially. For example, investing in the stock market or real estate can provide passive income streams, allowing you to achieve financial independence. Without investing, your money may lose value due to inflation, making it harder to achieve long-term goals like retirement or buying a home.

Who Can Benefit from Investing?

Investing is not just for the wealthy; anyone can benefit from it. Whether you're a young professional just starting your career or a retiree looking to supplement your income, investing offers opportunities for everyone. The key is to start early and stay consistent. Even small, regular investments can compound over time, leading to significant growth. For instance, someone who begins investing $100 a month at age 25 could potentially accumulate a substantial nest egg by age 65, thanks to the power of compound interest.

What Are the Common Barriers to Investing?

Despite its benefits, many people hesitate to invest due to perceived barriers. Some common obstacles include lack of knowledge, fear of losing money, and uncertainty about where to start. However, these barriers can be overcome with education and guidance. For example, online resources, financial advisors, and investment platforms make it easier than ever to learn about investing and get started. The saying "el que no invierte no gana" serves as a reminder that avoiding risks altogether can be the biggest risk of all.

How Can You Start Investing Today?

Starting to invest doesn't have to be complicated. Here are a few steps to help you get started:

- Educate yourself about different investment options, such as stocks, bonds, mutual funds, and real estate.

- Set clear financial goals, whether it's saving for retirement, buying a home, or building an emergency fund.

- Create a budget to determine how much you can afford to invest regularly.

- Choose a reputable platform or advisor to help you manage your investments.

- Start small and gradually increase your investments as you gain confidence and experience.

What Are the Best Investment Options for Beginners?

For those new to investing, it's important to choose options that are low-risk and easy to understand. Some of the best investment options for beginners include:

Read also:Ultimate Guide To Green Valley Ranch Everything You Need To Know

- Index Funds: These are low-cost funds that track a specific market index, such as the S&P 500.

- ETFs (Exchange-Traded Funds): Similar to index funds, ETFs offer diversification and liquidity.

- Robo-Advisors: These automated platforms create and manage a portfolio based on your risk tolerance and goals.

- High-Yield Savings Accounts: While not as lucrative as stocks, these accounts offer a safe way to earn interest on your savings.

Why Do Some People Think "El Que No Invierte No Gana" Is Risky?

Some individuals view investing as inherently risky because of the potential for financial loss. While it's true that all investments carry some level of risk, the key is to manage that risk through diversification and education. For example, spreading your investments across different asset classes can reduce the impact of a poor-performing investment. Additionally, understanding the phrase "el que no invierte no gana" can help shift your mindset from fear to opportunity, encouraging you to take calculated risks that lead to growth.

How Can You Overcome the Fear of Investing?

Overcoming the fear of investing begins with education and preparation. Start by learning about the basics of investing, such as how the stock market works and what factors influence investment performance. Next, set realistic expectations and understand that investing is a long-term strategy. It's also helpful to start with low-risk options and gradually increase your exposure as you gain confidence. Remember, the phrase "el que no invierte no gana" reminds us that avoiding risks entirely can lead to missed opportunities for growth.

What Role Does Compound Interest Play in Investing?

Compound interest is one of the most powerful tools in investing. It refers to the process of earning interest on both your initial investment and the accumulated interest from previous periods. Over time, this can lead to exponential growth. For example, if you invest $1,000 at an annual interest rate of 7%, your investment could double in about 10 years thanks to compound interest. This is why starting early and staying consistent is so important. The saying "el que no invierte no gana" underscores the importance of leveraging compound interest to build wealth.

How Can You Stay Consistent with Your Investment Strategy?

Consistency is key to successful investing. To stay on track, consider automating your investments so that a fixed amount is deducted from your account regularly. This removes the temptation to skip contributions during tough financial times. Additionally, review your portfolio periodically to ensure it aligns with your goals and risk tolerance. Remember, the principle of "el que no invierte no gana" applies not only to starting your investment journey but also to maintaining it over the long term.

In conclusion, the phrase "el que no invierte no gana" serves as a powerful reminder of the importance of taking action to achieve financial growth. By understanding the barriers to investing, exploring the best options for beginners, and leveraging tools like compound interest, you can unlock opportunities for long-term success. Whether you're just starting out or looking to refine your strategy, embracing this mindset can help you build a brighter financial future.

Exploring The Big Hand Small Waist Meme: Origins, Impact, And Why It’s Trending

Discover The Best HSR Discord PFP Male Ideas For Your Profile

Exploring The Lives Of Any Female Born After 1993: A Journey Through Modern Times

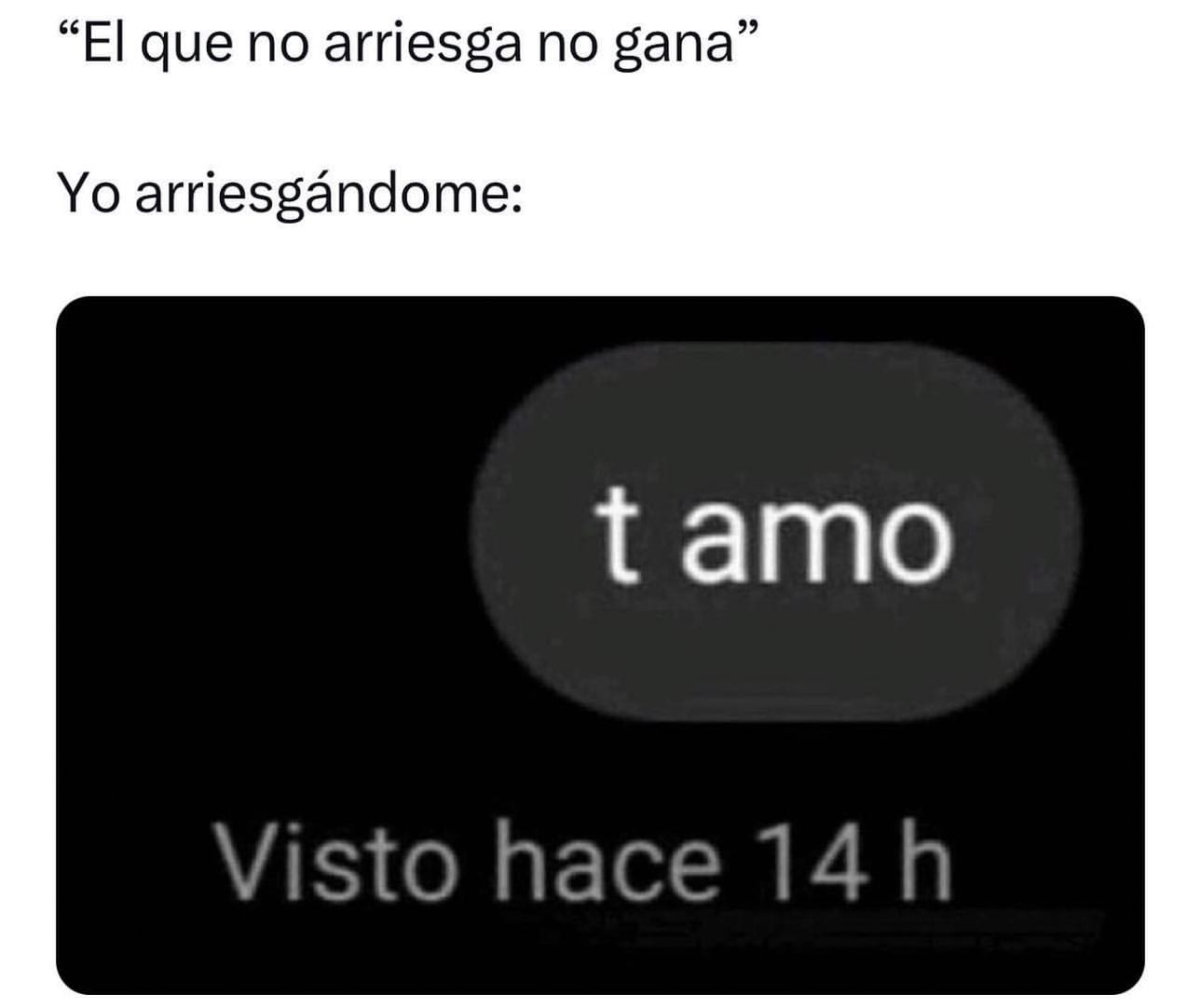

"El que no arriesga no gana". Yo arriesgándome t amo. Memes

El que no gana no ama español Latino Online Descargar 1080p